Within South Africa’s real estate domain, the industrial property market stands tall, boasting low vacancy rates and robust rental growth. Cape Town emerges as a regional leader with a remarkable 17% surge in rentals compared to pre-pandemic levels in 2019.

This resilience of the industrial property market is indeed surprising, evident in its national vacancy rate of merely 3.7%. However, while this sector holds its ground firmly, the broader landscape for property owners remains uncertain and challenging, grappling with the ripples of subdued global and local economic growth.

Locally, challenges loom large, including a persistent power crisis, service delivery lapses, and a steep escalation of rates and taxes. Amid these hurdles, the office market paints a less promising picture, exhibiting the weakest income-growth expectations, reflected in its high capitalization rates.

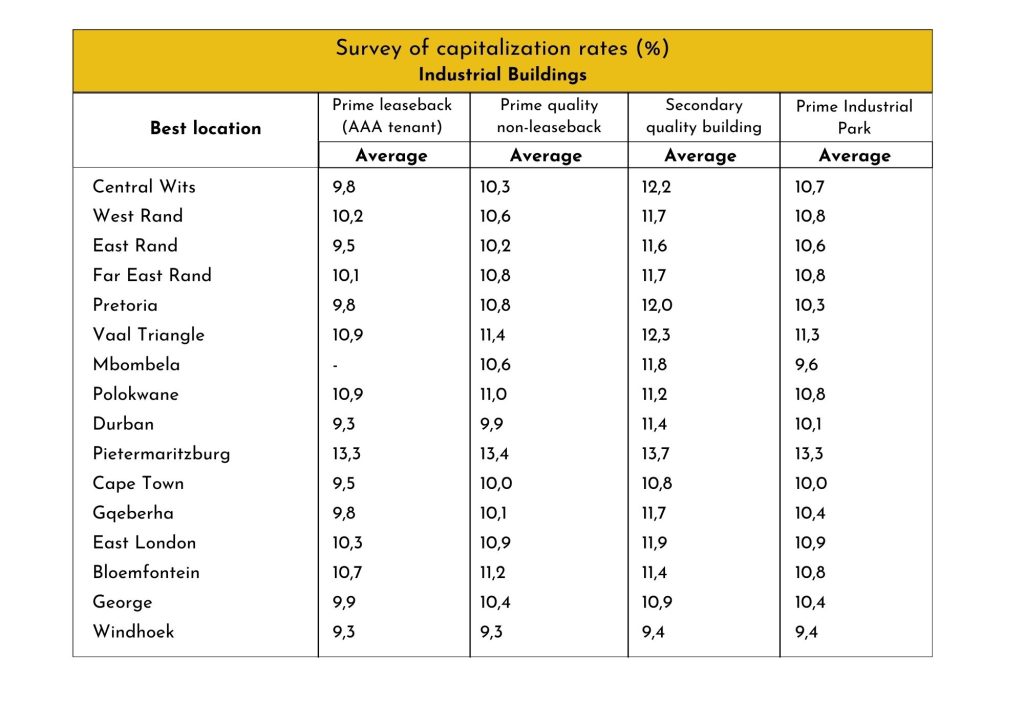

Delving deeper into the numbers, the industrial market, maintaining its prime position, exhibits its prowess with low vacancies and consistently robust rental growth. The weighted cap rates for different property categories—11.1% for grade-A multi-tenanted decentralized offices, 9.8% for prime industrial leasebacks, and 9.7% for regional shopping centres—reveal the varying performance within the market segments.

Escalation rates, averaging 7.2% in 2023, maintain a consistent stride from the preceding year, albeit experiencing a slight decline from pre-pandemic levels of 7.9% in 2019. However, market forecasts indicate a potential overestimation, as observed by subscribers to Rode’s SA Property Trends.

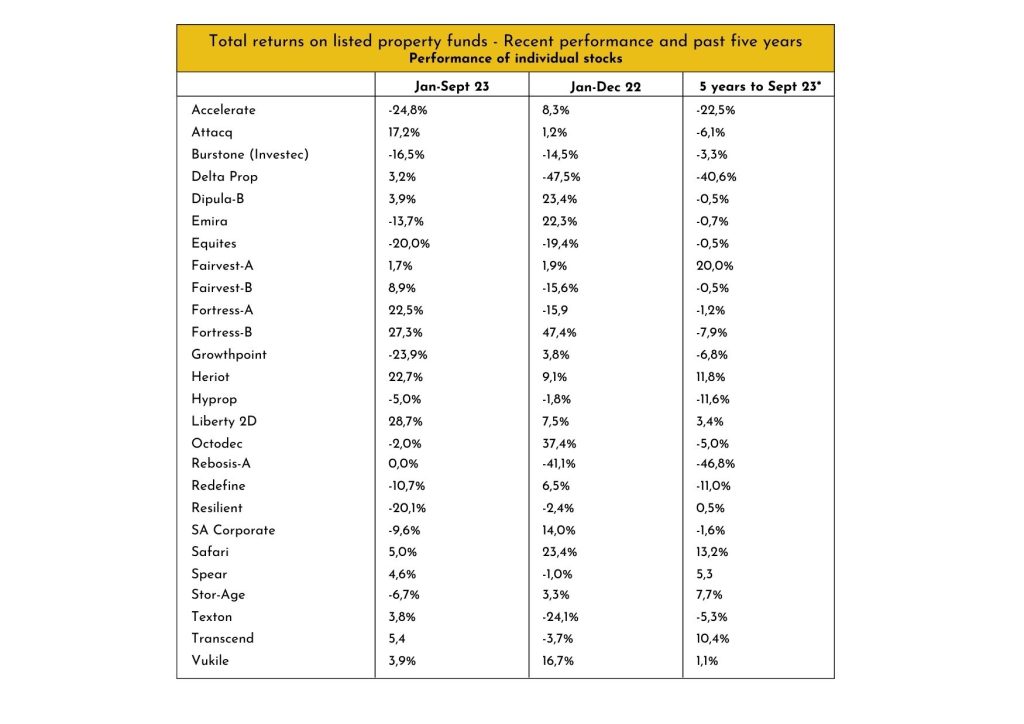

Listed property performance has been lacklustre, with the SA REIT Index recording a negative 7.8% total return in the first nine months of 2023, lagging behind equities, bonds, and cash. Nonetheless, exceptions like Liberty Two Degrees (L2D), Fortress, Heriot, and Attacq managed to achieve double-digit total returns, offering a glimmer of positivity amidst the gloom.

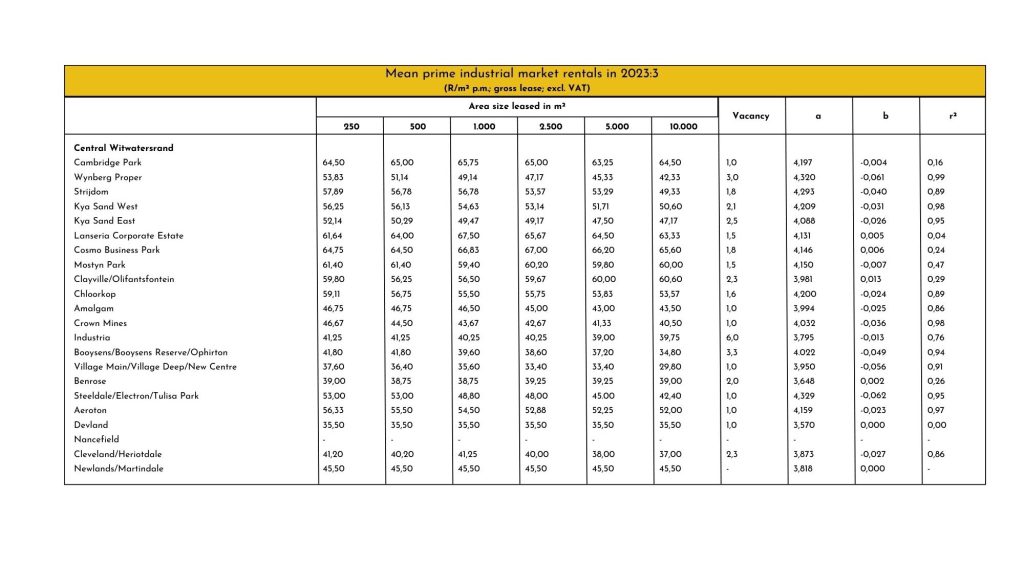

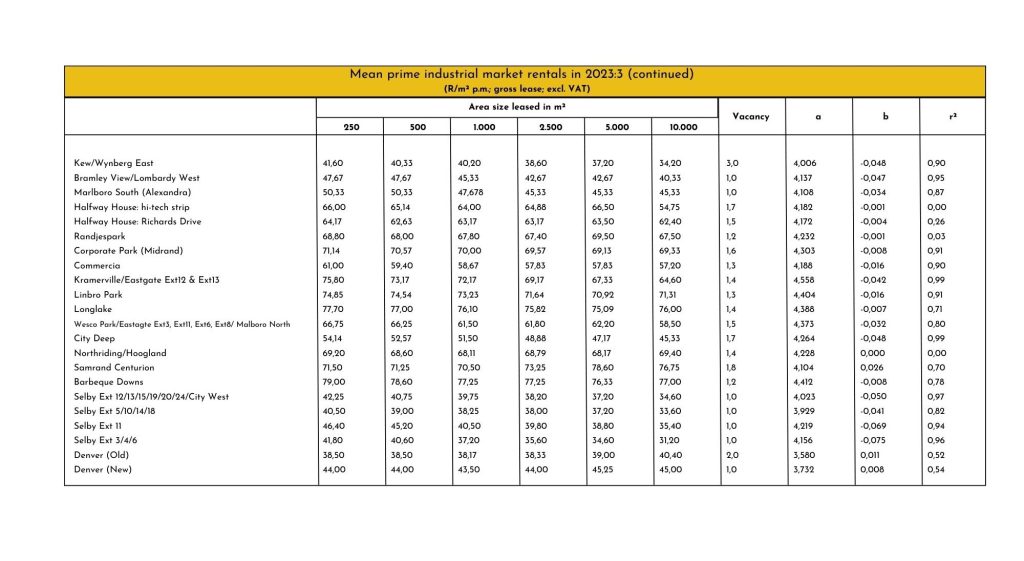

Rode’s third-quarter 2023 survey reaffirms the industrial property market’s resilience, underscored by low vacancies driving stronger rental growth. However, the pace of growth has moderated slightly due to economic challenges, especially impacting the manufacturing and retail sectors. Cape Town remains a beacon of strength regionally.

Delving into the market dynamics, the performance of manufacturing and retail sectors remains pivotal. Industrial spaces are in demand for manufacturing production purposes and warehouses, fuelled by local production and imports sustained by the retail sector. A transformative force within this market is the rising demand for new-generation warehouse or distribution spaces. This surge stems from modern racking systems enabling higher stacking heights, potentially rendering existing distribution centres outdated. Simultaneously, the exponential growth of online retail sales, accounting for 4.7% of total retail sales in 2022, fuels the transformation.

While South Africa’s online retail landscape is distinct from developed nations, local retailers embracing online platforms like Checkers and Woolworths signal its growth potential. Additionally, the imminent launch of Amazon Marketplace in 2024 is poised to further invigorate the local online retail scene. In essence, amid a landscape fraught with uncertainties, the industrial property market in South Africa stands tall as a resilient pillar, leveraging low vacancies and rental growth. Yet, the evolving market dynamics shaped by economic fluctuations and technological advancements continue to redefine and reshape this crucial sector.

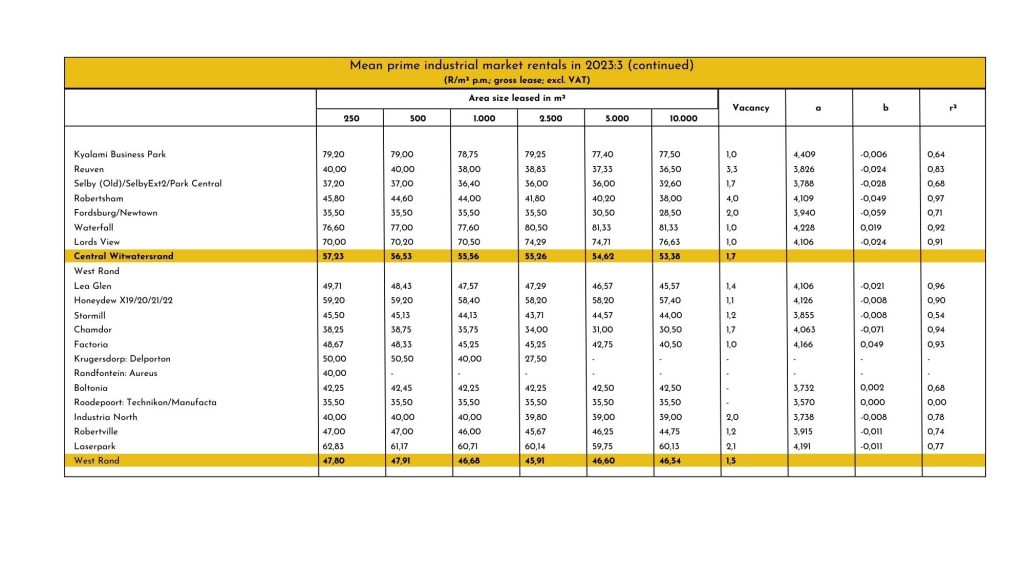

Rental Rates: Reflect achievable rates for industrial and

warehouse spaces, averaged across cities. They’re based on gross leases and

typically span 3 to 5 years.

Source: Rode Report